My friend, Sarah, made $5000 per month and spent that money in less than 2 hours. However several times in a row she didn’t have enough money to pay her bills. She believed that she needed to make more money by getting another job. When in reality, she just needed to learn what money is and how to budget.

WHAT IS MONEY?

According to wordnik.com, money is a currency or medium that can be exchanged for good, services, used in the stock markets, but also your salary. The 3 types of money in history are: bartering system, commodity money, fiat money.

BARTERING SYSTEM

Before money came along, there was a bartering system, it acting like a system of trade. Example: two parties had goods that each wanted. They would entered into a barter system, where each would get what the other had.

COMMODITY MONEY

Commodity Money was type of goods that functioned as currency. They were widely desired, valuable, durable, portable, & easily storable. Example: precious metals like gold.

FIAT MONEY

Fiat Money is a value set by supply & demand, which is the basis for the creation of money. According to investorwords.com, fiat money is: money that has no intrinsic value & cannot be redeemed for gold or silver coins or any commodity,which is made legal by government decree. This is the type of money that we use today. Do I really need to give an example?!

MONEY & MENTAL HEALTH

If you lack money or are in debt, this might symbolize struggle, vulnerability, and fear. Thus if you feel awful about your financial situation it will affect your overall mental health. Several other mental issues could arise from this:

–mania

–hypomania

–anxious

–loss of motivation to keep financial control

–stressed

–worry

–depression

–thoughts of suicide & actually going through with it

Therefore balancing your check book and budgeting is the utmost important.

BUDGETING:

Budgeting is of the utmost important thing you can do in your financial life. There are many ways you can budget, but this the method I use:

BIGGEST BILLS

(mortgage/rent, car, insurance, car, debt, etc.)

OTHER BILLS & SAVINGS

(phone, cell phone, cable/dish, internet, utilities, etc.)

NEEDS

(food, clothes, hygiene, gas, health)

WANTS

(health, beauty, TV/movies, books, video games, things not needed)

Also create a log of where all your money is going and how much you are spending in each area.

EXAMPLE:

Let's take the above paycheck amount at the beginning: $5000.00

BUDGETING Price New Balance

RENT $1,000.00 $4,000.00

UTILITIES $550.00 $3,450.00

INSURANCE $280.00 $3,170.00

DISH OR CABLE $180.00 $2,990.00

CELL PHONE $50.00 $2,940.00

NEEDS $300.00 $2,640.00

WANTS $1,000.00 $1,640.00

All you would do to substract the first number in the price to get the new balance, then substract the next price from the new balance. This is both a log and a budget.

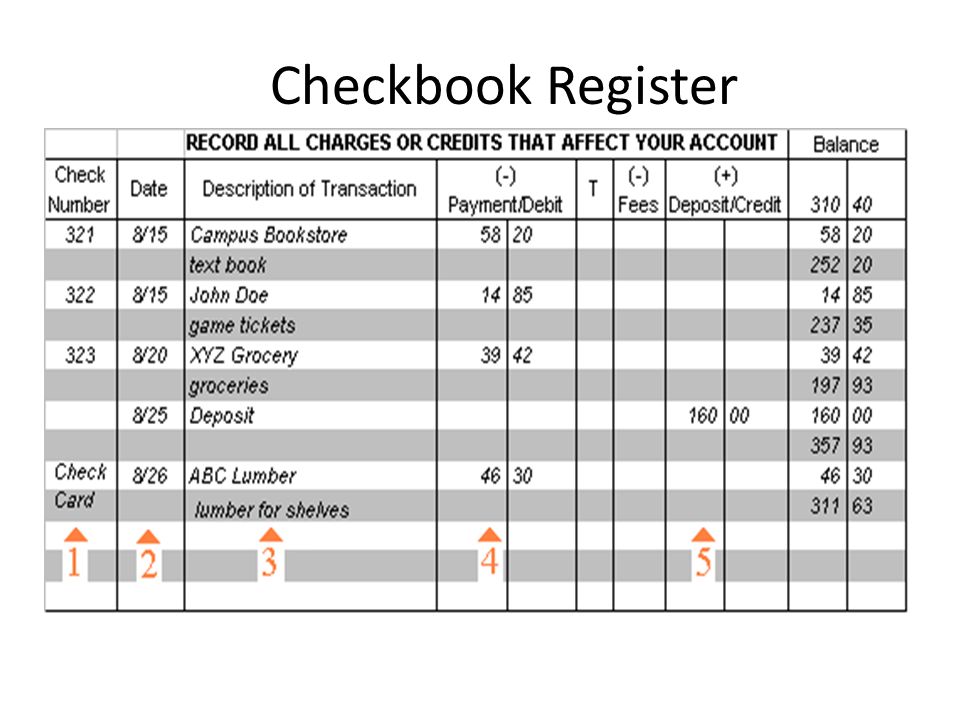

BALANCING A CHECK BOOK

Balancing a check book is a simple as the above log and budget.

This in this register is an example of how to balance a checkbook.

1.check number – can also put if used card

2.date when used

3.store & what item(s) were

4.total amount had to pay out

5.amount put into account

The balance is then added or substracted depended on if you took money out or put money in, just like at the log & budget.

In conclusion, budgetting and balancing out your checkbook is important in order to handle money and still have enough in case of emergencies. Money does not define who you are. You as a person are not your money. Money should work for you, not the other way around. Money is important, but it should not rule you. It should not be your life.

SOURCES & FURTHER READING